American opportunity credit calculator

Please contact Savvas Learning Company for product support. If you qualify you may see a reduced tax bill or a bigger refund.

American Opportunity Tax Credit Aotc Definition

The National Credit Union Share Insurance Fund NCUSIF provides all members of federally insured credit unions with 250000 of coverage for single ownership accounts at an NCUA credit union.

. Coming together as a blended family in 2014 we made a home of an austere house void of a feminine touch for years and worse lacking necessary functionality. Direct response advertisers often consider CPA the optimal way to buy online. Cost per action CPA also sometimes misconstrued in marketing environments as cost per acquisition is an online advertising measurement and pricing model referring to a specified action for example a sale click or form submit eg contact request newsletter sign up registration etc.

The credit typically offers greater tax savings than other education related tax benefits since it reduces the tax you owe on a dollar-for-dollar basis rather than just reducing the amount of income subject to tax. The American opportunity credit has not been claimed by you or anyone else see below for this student for any 4 tax years before 2021. Our American Express Savings allow us to aggressively save in a manner that soon afforded us the opportunity to do the necessary remodeling to accommodate our instant family.

Depending on the contract other events such as terminal illness or critical illness can. 31 of American consumers who have used a buy now pay later service trust those services more than credit card companies when it comes to fair business practices. The following expenses qualify for the American Opportunity Tax Credit.

Please note 1000 points is the minimum amount of points needed for transfer into most participating frequent customer program accounts. Qualified education expenses that are tuition and certain related expenses required for enrollment or attendance at an eligible educational institution. In the fields provided input the total amount charged on your credit card its annual interest rate and the percentage that constitutes a minimum payment on the card followed by the dollar amount of.

Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. American Opportunity Credit phaseout If your modified adjusted gross income MAGI is more than 80000 160000 if youre married filing jointly your eligibility will start to phase out meaning you may only qualify for a partial credit or none at all. American Opportunity Credit requirements and eligibility.

Coming together as a blended family in 2014 we made a home of an austere house void of a feminine touch for years and worse lacking necessary functionality. Earn a credit limit increase in as little as 6 months. The company offers a wide breadth of options from no-annual fee cards and to.

The Amex Optima is an unsecured card where the Discover it Secured Credit Card offers a card requiring a deposit as cash. The gov means its official. Terms and conditions apply.

The Membership Rewards program offers Card Members the opportunity to transfer points to 19 reward program partners which is more than any other major US. To claim the. The California Earned Income Tax Credit CalEITC and the Young Child Tax.

This calculator will show just how much total interest you will pay if you only make the minimum payment required on your credit card balance. Solar energy capacity increased by 17 in 2007 reaching the total equivalent of 8775 megawatts MW. American Express Optima vs.

Expenses paid for yourself spouse or dependent on your return. Find new and used cars for sale on Microsoft Start Autos. Use this calculator to see if you qualify.

Get a great deal on a great car and all the information you need to make a smart purchase. The ITC is based on the amount of investment in solar property. How much did you earn from your California jobs in 2021.

Employers may meet their business needs and claim a tax credit if. American Express offers myriad credit cards for consumers and for businesses. It gives me the opportunity to give this.

The American opportunity credit allows taxpaying students or their parents the opportunity to reduce the cost of attending college. The Fair Credit Billing Act FCBA sets a limit of 50 in total liability for fraudulent credit card transactions made with your card and liability is set at 0 for fraudulent transactions made. Variable APRs range from 2224 3174.

If the American opportunity credit has been claimed for this student for any 3 or fewer tax years before 2021 this requirement is met. Monthly enrollment opportunity if your household income doesnt exceed 150 of the poverty level In September 2021 the Biden administration finalized a new monthly enrollment opportunity for people who are subsidy-eligible and whose household income doesnt exceed 150 of the federal poverty level. Federal government websites often end in gov or mil.

The Solar Energy Industries Associations 2008 US. In the case of the Section 48 credit the business that installs develops andor finances the project claims the credit. The SEIA report tallies all types of.

Solar Industry Year in Review found that US. Discover it Secured Credit Card. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

Credit card rewards program. Before sharing sensitive information make sure youre on a federal government site. Only 22 said credit card.

A tax credit is a dollar-for-dollar reduction in the income taxes that a person or company would otherwise pay the federal government. 300 5000 credit limits. Our American Express Savings allow us to aggressively save in a manner that soon afforded us the opportunity to do the necessary remodeling to accommodate our instant family.

Solar energy deployment increased at a record pace in the United States and throughout the world in 2008 according to industry reports. Credits for working Californians. Find the best CD rates by comparing national and local rates.

American Express Credit Cards Overview. 0 Annual Fee. Bankrate compares thousands of financial institutions to make it easy for you to apply for the best certificate of deposit rate.

Education Loan Eligibility How To Get Student Loan The Education Loan Would Be Provided To Those Students Who Student Loans Private Student Loan School Loans

American Opportunity Tax Credit Aotc Definition

American Opportunity Tax Credit H R Block

Online Finance Degree Leads To Golden Career Opportunities Finance Degree Business Management Degree Accounting Services

American Opportunity Tax Credit Aotc Definition

Helping To Open Doors For Growth Agricultural Loans In 2022 Business Loans Commercial Loans Rewards Credit Cards

Pin On Tax Laws Of Usa

Instant Approval Credit Cards Business Certifications Rummy Hacks

The Affordability Calculator Is Calculated Based On The Percentage Of Your Income Spent On Mo Mortgage Payment Debt To Income Ratio Mortgage Payment Calculator

American Opportunity Tax Credit Calculation E File Com

Pin By Elmira Clarke On 5 Linx Network 5linx Credit Card Processing Debit Card

Financial Planning For Seniors Financial Planning Money Management How To Plan

Things To Know About Secured Credit Cards Unsecured Credit Cards Improve Credit Interest Calculator

Understand The Background Of Floor And Decor Credit Card Now Floor And Decor Credit Card Floor Decor Good Credit Credit Score

Gallup Latest Data On Homeownership And Purchasing Home Ownership Home Buying Tips Real Estate Infographic

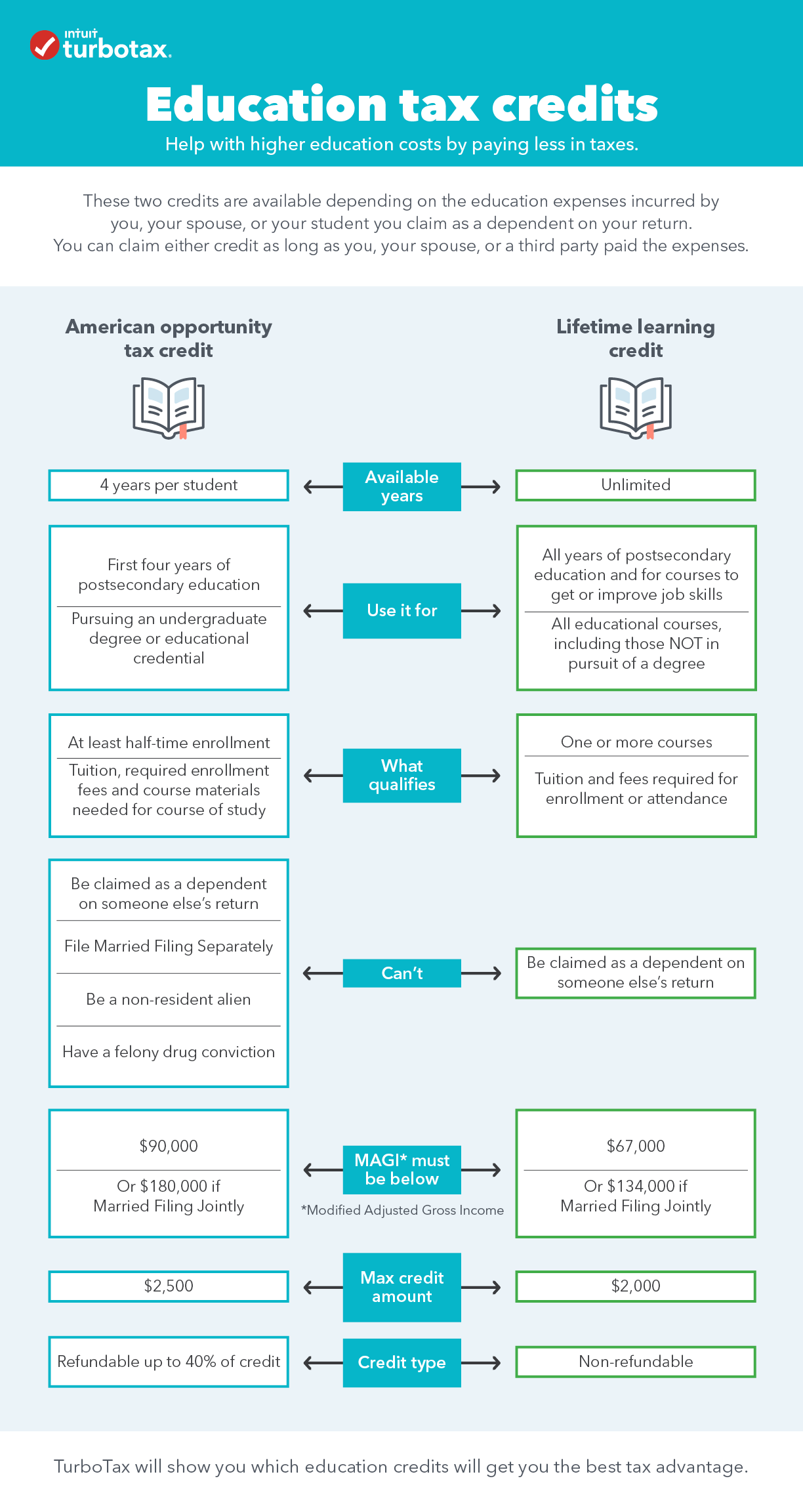

What Education Tax Credits Are Available

The Discover It Cash Back Card Is A Good Fit For Anyone Who Wants The Opportunity To E Best Credit Cards Balance Transfer Credit Cards Best Credit Card Offers